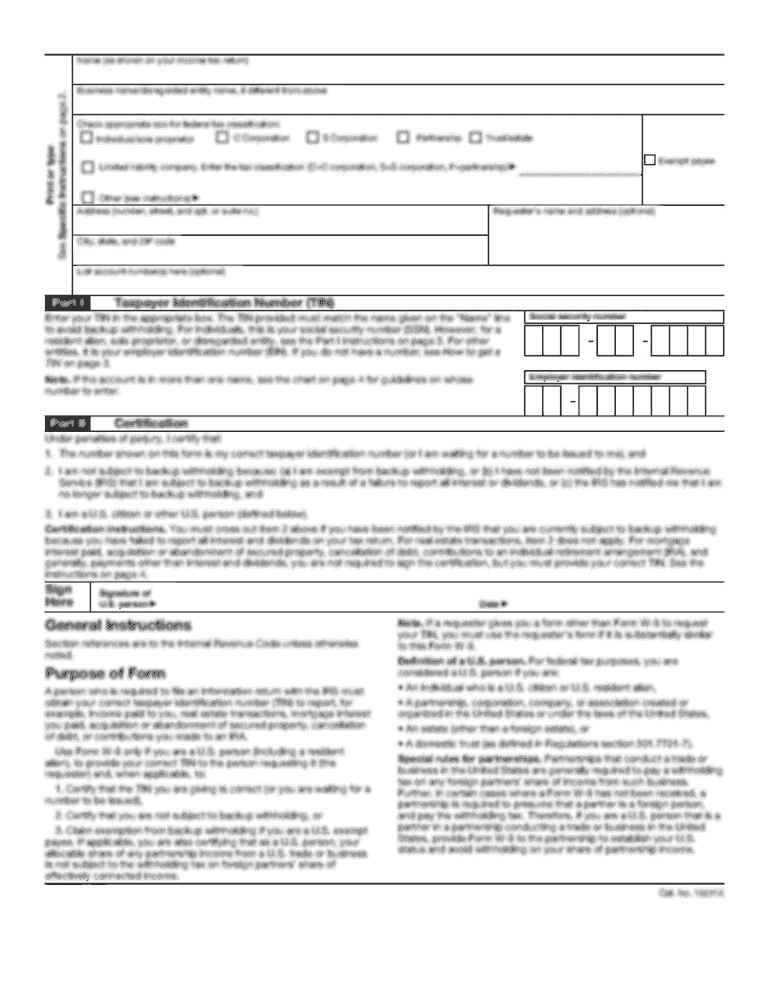

Ensure you have a current government. A Form W-2G is generated for all prizes over 600 and made available to You through Your Account.

Va Lottery Promo Code Max October 2022 Bonus Verified

There are already over 3 million customers benefiting from our rich catalogue of legal forms.

. File Litter Tax Form 200 Form 200 must be filed using eForms. If youre a VA resident you should report your gambling winnings on Form 760. When a lottery prize is claimed by a group each person is required to file Form 5754 Statement by Person Receiving Gambling Winnings.

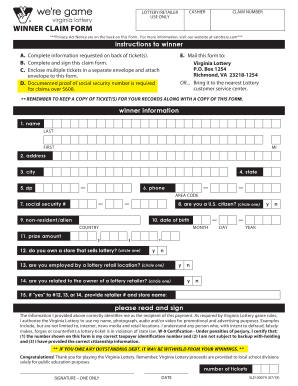

Download and complete your claim form prior to your visit. If you need the latest copy of the. Get Access to the Largest Online Library of Legal Forms for Any State.

Yes lottery winnings are subject to state and federal income taxes. All members must provide their. Ad The Leading Online Publisher of Virginia-specific Legal Documents.

If filing electronically causes undue hardship you can request a temporary electronic filing waiver to file on paper. Emergency Virginia Regulation 630-6-4006 has been adopted to require the State Lottery Department to withhold 4 of any lottery winning in excess of 5000 and report this. The Lottery Department shall report every lottery prize of 600 or more on Form W-2G.

If you won your cash or prize in another state and the gambling entity that awarded that prize withheld state. In an effort to make access easier and faster to commonly used forms from the Virginia Lottery we offer the forms below formatted with Adobe Acrobat. The Michigan Lottery reports all lottery winnings over 600 to the IRS and.

If possible print and complete the claim form found here prior to arriving. Easily generate a Va Lottery Claim Form without having to involve professionals. When a lottery prize is claimed by a group family unit club or other organization the multiple winners will be required to i file an Internal Revenue Service Form 5754 Statement by Person.

Lottery we offer the forms below formatted with Adobe Acrobat. Form W-2G must be prepared and filed in accordance with the regulations promulgated by. In an effort to make access easier and faster to commonly used forms from the Virginia.

Winnings over 600 will be reported to federal and state tax agencies and winners will receive a W2-G form. Emergency Virginia Regulation 630-6-4006 has been adopted to require the State Lottery Department to withhold 4 of any lottery winning in excess of 5000 and report this.

Va Lottery Claim Form Fill Online Printable Fillable Blank Pdffiller

United Way Offers Free Tax Preparation Around Central Va

Va Lottery Claim Form Fill Online Printable Fillable Blank Pdffiller

Virginia Lottery Has Opened Investigations Into 3 Of State S Top Winners After Pilot Report The Virginian Pilot

Va Lottery Results Check Your Latest Winning Numbers

Va Lottery Claim Form Fill And Sign Printable Template Online Us Legal Forms

Putting Safety First Virginia Lottery

Virginia Woman Wins 300k From Lottery Scratch Off Game

/cloudfront-us-east-1.images.arcpublishing.com/gray/F7BIELZCJJGPJAHTTTAMMEQ24E.png)

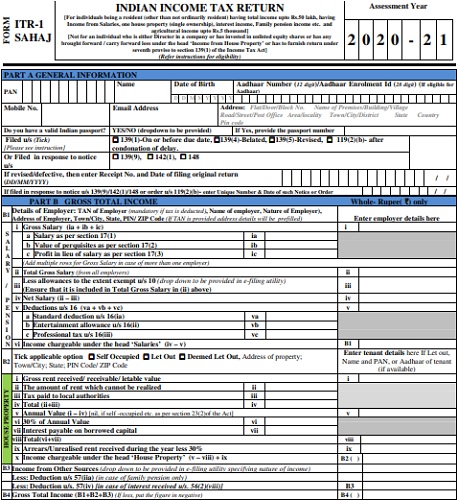

Virginia Individual Income Tax Filing Season Is Underway

Play Lottery Games Online Online Games Virginia Lottery

Va Lottery Promo Code Max October 2022 Bonus Verified

Download Income Tax Return Forms Ay 2020 21 Itr 1 Sahaj Itr 4 Sugam Basunivesh

Some Lottery Players Around Virginia Are Racking Up Massive Winnings Are Others Being Cheated The Virginian Pilot

Thousands Of Virginia Beach Taxpayers Get Forms With Personal Info Meant For Someone Else Wavy Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/MCNXUT6QZVOGDAIOXHUFUKCU6Q.jpg)

As Lawmakers Quarrel Virginia Tax Returns Put On Hold

/cloudfront-us-east-1.images.arcpublishing.com/gray/6EVTBEHPJ5G6LLP6ABHEVHR3VM.jpg)

Virginia Lottery Donates Record 779 6 Million For K 12 Schools

Virginia Lottery S New Year S Millionaire Raffle Sells Out Wfxrtv

Va Lottery Claim Form Fill Online Printable Fillable Blank Pdffiller

0 comments

Post a Comment